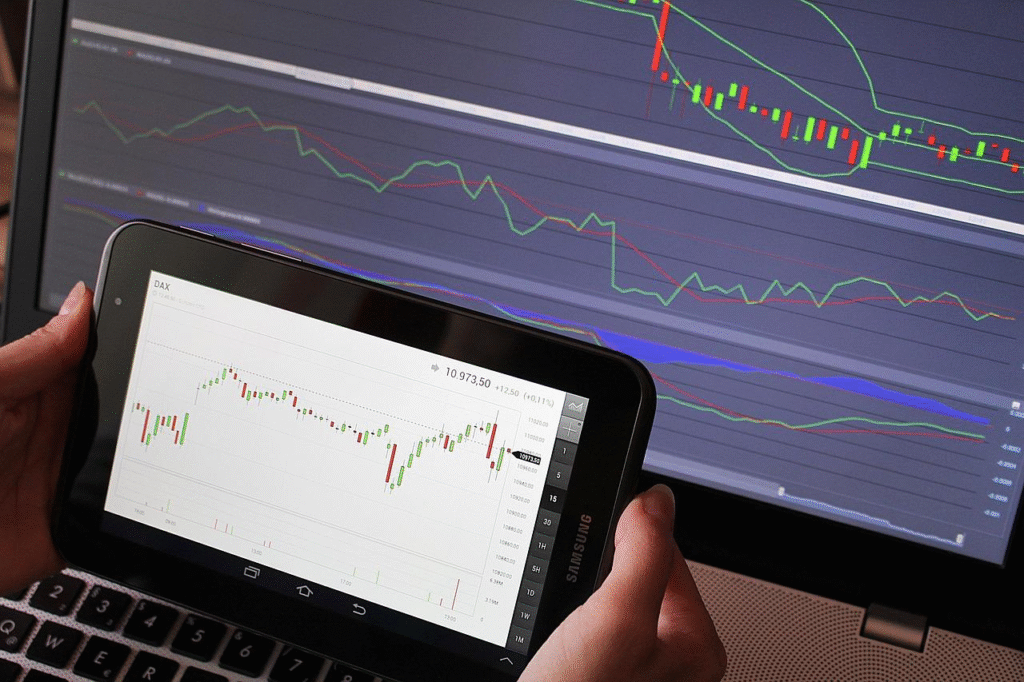

It does not matter whether you are a beginner forex trader or a professional; in order for you to survive and thrive in the forex market, you must prioritize preserving your capital through effective and efficient risk management rules. We have given below 3 top rules that can enhance your chances for success while limiting the risks for each trade.

Contents

Set The Risk And Reward Parameters Strategically

If you genuinely want to survive the forex market, you must be strategic when setting the risk and reward parameters. However, if you are new to forex trading, you might want to do your research on prop firms and understand their rules first. For instance, if you join Maven Trading, go through their guidelines, and understand the potential profit and payout rules, you can set the reward and risk parameters accordingly. Nonetheless, when it comes to the standard guidelines for capping your risk for each trade, it is to follow the one percent rule.

What is the One Percent Rule?

According to the popular and widely accepted 1% rule, you should never risk more than 1% of your trading capital on any single trading position. What this means is that if you have a trading account with 10,000 U.S. dollars capital, you should risk 1% of the total trading capital, which means that in this example, your maximum loss will be $100 per trade.

Be Mindful When Using Leverage

Now, if you want to thrive as a prop trader, especially in the forex market, you must understand the importance of using leverage the right way. As a matter of fact, you should use leverage strategically to control your trading position size. It would not be wrong to state that the ability to calculate and control your position size is one of the most important skills that you need for a successful forex trader.

With that set, you should know that your trading position size is dependent on your potential risk tolerance and the distance to your stop loss, which is why you should never treat it as a random number.

How to Use Leverage with Caution?

Now, the important question is, how you, as a forex trader, should use leverage with caution. We are here to tell you how using leverage can amplify not only your profit but also your trading losses, which is why leverage is a leading cause of blown trading accounts and margin calls.

You get the point: despite the fact that high leverage can seem appealing, you must be mindful that it will also massively increase your risk, which is why, as a beginner trader, especially, you should opt for lower leverage settings.

Know How to Execute Trades with Exit Orders

The third risk management rule that you must ace as a forex trader is to know how to use stop-loss orders. The stop-loss order can prove incredibly useful in saving your trading account from closing, which can happen if you go through an outsized trading loss. The way stop loss orders work is that they close a losing trading position at a pre-established price level and hence prevent the shutting down of your trading account. This aspect indicates the importance of never moving or removing a stop-loss order, as doing so can result in devastating trading losses.

Conclusion

To succeed in the forex market whether you’re just starting out or already trading professionally. Risk management must be your foundation. By setting strategic risk-reward parameters, using leverage with precision, and executing trades with disciplined exit orders, you protect your capital and position yourself for long-term growth. These principles aren’t just best practices. They’re survival tools in a market that rewards consistency over bravado. Treat every trade as a calculated decision, not a gamble, and you’ll build the habits that separate sustainable traders from short-lived speculators.